Assemblyman

Michael Cusick

UPDATE

from Albany

Spring 2012

ENSURING THE FRESH KILLS LANDFILL REMAINS CLOSED

The Fresh Kills landfill was an environmental nightmare for Staten Island natives who remember the effects of living in a community with a garbage dump. Staten Islanders know that the promises from the city for how the facility will be used have not been fulfilled. The landfill was opened in 1947, and was intended to be opened for only 20 years. Additionally, closing the Fresh Kills landfill was a collective effort of all elected officials on local, state and federal levels of government for more than 50 years.

Assemblyman Cusick sent a letter demanding that Mayor Bloomberg follow the spirit and intent of current law and withdraw plans to explore the re-opening of Fresh Kills landfill as a site for a waste to energy facility. The request for proposals (RFP) issued by the city, indicate that Fresh Kills is the only site so far identified for such a plant.

In his letter, Cusick reminded the Mayor that Chapter 107 of the Laws of 1996 permanently closed the Fresh Kills landfill effective January 1, 2002. That law, Cusick contends, did not just permanently stop landfill operations at Fresh Kills, it closed the site to all garbage forever. Cusick explained that the 1996 statute specifically states that Fresh Kills shall not accept solid waste for “disposal” beyond the end of 2001. “Disposal,” Cusick maintains, encompasses the “burning of such waste as fuel for the purpose of thermal destruction of waste, and the burning of such waste as fuel for the purpose of recovering reusable energy.” The prohibition of “solid waste disposal” at Fresh Kills eliminates the lawful siting of a waste to energy facility there.

The Mayor has reconsidered this proposal following Cusick’s interpretation of the 1996 law and the strong opposition from Staten Island representatives and the community.

“Staten Island has suffered long enough from the effects of the Fresh Kills Dump, and we will not be going back to that,” said Cusick. “I will not stand by and let the City of New York continue to give Staten Island the short end of the stick on this issue—consider it dead on arrival.”

Assemblyman Michael Cusick stands with Senator Andrew Lanza and New York City Schools Chancellor Dennis Walcott to announce the restoration of yellow school bus service for Staten Island 7th and 8th graders.

RESTORING YELLOW SCHOOL BUSES FOR 7th AND 8th GRADERS

Assemblyman Cusick passed legislation that would exempt New York City from the “Like

Circumstances” clause of New York State Education law (S.6027/A.8683),

with regard to 7th and 8th grade yellow school busing that was previously provided to Staten Island

students. This exemption would allow the New York City Department of Education to restore busing

service for 7th and 8th grade general education students. The Department of Education cited the

“Like Circumstances” clause as the main reason for revoking the variance for 7th and 8th grade

students in 2009. This action would remove this barrier from the City Department of Education so

that the school bus service can be restored for our children.

“Staten Island has a unique transportation situation that needs to be addressed. It is important

for the safety of our children that we remove all barriers that would prevent the city from providing

this necessary service,” said Cusick. “I am glad the Mayor and the Chancellor agree that the busing

on Staten Island needs to be restored.”

The final approved budget increases school aid by $805 million statewide, with $292 million allocated

for New York City. This money was instrumental in the decision of the city to reinstate the school bus

service.

LOWERING INCOME TAX RATES FOR MIDDLE CLASS FAMILIES

A moderate income family making $40,000 a year paid the same tax rate—6.85%—as a family

making $400,000, $4 million, or any higher amount. To fix this discrepancy, Assemblyman

Cusick helped pass legislation to lower the tax rate for middle class families in New York.

As a result, 4.4 million middle class families in New York will see a decrease in their tax

rate beginning next year. Under the deal, middle class residents will see their tax rate drop

from 6.85% to 6.45%, a savings of $300 to $400 a year.

Assemblyman Cusick is also the author of a bill which would control the ever rising property

tax by limiting the amount by which the City of New York may increase property taxes each

year (

A.4741). Under this legislation, the City would not be able to raise the property tax levy by more than 2 percent or the rate of inflation (whichever is less). This measure will limit the city from placing unfair burdens on property owners with outrageous increases while helping the property owner with a better sense of how to budget for their taxes.

RESTORING EPIC FUNDING FOR SENIORS

The 2012-2013 State Budget restores $30.6 million to the Elderly Pharmaceutical Insurance Coverage (EPIC) program to help reinstate co-payment assistance for approximately 300,000 EPIC enrollees. Currently, seniors enrolled in the EPIC program are forced to pay 25 percent of the cost of each prescription drug. With the co-payment assistance restored, enrollees will return to paying no more than $20 co-payment for each prescription.

SALES TAX EXEMPTION FOR CLOTHING AND FOOTWEAR UNDER $110

New York State will once again remove the 4 percent state sales tax on clothing, footwear and related items sold for less than $110 each as of April 1. The tax-free offer applies to all relevant items purchased in person, over the Internet, by phone, or by mail. This will be the second consecutive year for the program, with the qualifying amount for the exemption doubling over last year. Last year, it applied to apparel at or below $55.

FIGHTING THE PORT AUTHORITY TOLL INCREASES

The Port Authority toll increases are a potential killer of small business on Staten Island. These tolls

deter businesses from expanding, drive up the price of goods, and strain the wallets of working people

who need to leave the island for work or to see family. The Commissioners of the Port Authority need

to recognize that Staten Island is geographically unique and its residents should be granted a

significant discount for crossing the bridges under its control. By reducing the threshold necessary

for Islanders to receive a discount, the PA has taken a small first step. I will continue to push for a

business discount so that Staten Island businesses are not at a competitive disadvantage.

Assemblyman Cusick is holding the Port Authority responsible in a bipartisan fashion. He is the prime

sponsor of A.8677. This bill is a comprehensive package of reforms to ensure

the proper functioning of the Port Authority of New York and New Jersey as an open, transparent authority.

Assemblyman Cusick’s bill would:

CUTTING THE MTA TAX ON SMALL BUSINESS

Cutting the MTA payroll tax provides relief to over 700,000 small businesses and self-employed New Yorkers.

Assemblyman Cusick voted to:

-

Eliminate the tax for all small businesses with annual payrolls less than $1.25 million.

-

Eliminate the tax for self-employed individuals who make less than $50,000 annually.

-

Reduce the tax for companies with payrolls less than $1.75 million.

-

Exempt all public and private elementary and secondary schools from paying the tax.

The final approved budget provides $4 billion to the MTA for increased service on Staten Island.

-

Create an independent central procurement officer within a central procurement office.

-

Create standards for procurement and lobbying, including limitations on procurement lobbying.

-

Establish requirements for a public process to dispose of property at fair market value.

-

Require an independent audit of the Port Authority.

-

Require specific requirements for open public meetings and publication of minutes of meetings of the Board of Commissioners.

-

Establish Audit, Finance and Governance Committees.

-

Require financial disclosures and training for Commissioners.

-

Require certification by the Chairman, Vice-Chairman and CFO that financial reports are complete and accurate.

-

Create a fiduciary responsibility for Commissioners.

The Commissioners of the Port Authority need to recognize that Staten Island is geographically unique and its residents should be granted a significant discount for crossing the bridges under its control.

Assemblyman Cusick is the prime sponsor of Assembly bill A.348, which would require the Port Authority to acquire an economic impact statement prior to increasing bridge and tunnel tolls.

Under the bill, the Port Authority can only increase their tolls on any project operated by the authority within 30 days after the issuance of an economic impact statement on the proposed increase. This statement, conducted by an independent contractor, is to show the effects of the proposed increase in tolls as it relates to the surrounding communities.

FIGHTING THE PRESCRIPTION DRUG EPIDEMIC

There is an information gap between doctors and pharmacists which is allowing addicts and abusers to slip through regulatory cracks. Only a real time system like “I-STOP” will fix it. To best protect the public, medical professionals must be able to update records of controlled substance prescriptions when they are written or filled.

Assemblyman Cusick is the prime sponsor of “I-STOP” legislation (A.8320) which creates and mandates the use of a “real time” database for medical professionals and pharmacists. This would be another significant step in eradicating prescription drug abuse by virtually eliminating doctor shopping, and other abuses in the system. This legislation is the best solution to ensure patients receive the medication they need, and those who profit off of abuse receive the justice they deserve.

In addition, Assemblyman Cusick is also the prime sponsor of a bill to provide pharmacists access to the

existing New York State prescription drug monitoring program resources (A.3806).

He is also sponsoring another bill that would establish a new prescription monitoring program

(A.3807).

Here are some statistics regarding the prescription drug epidemic:

-

Fatalities on Staten Island linked to accidental overdoses of prescription drugs increased by 147 percent from 3 per 100,000 in 2005 to 7.4 per 100,000 in 2009 – more than double the rate of any other borough.

-

Of the five New York City neighborhoods with the highest per capita rates of prescriptions filled for narcotic painkillers, four of the top five were on Staten Island.

-

In New York City, the rate of prescription pain medication misuse among those age 12 or older increased by 40 percent from 2002 to 2009, with nearly 900,000 oxycodone prescriptions and more than 825,000 hydrocodone prescriptions filled in 2009.

-

Statewide, prescriptions for hydrocodone have increased 16.7 percent, while those for oxycodone have increased an astonishing 82 percent.

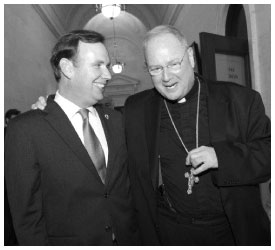

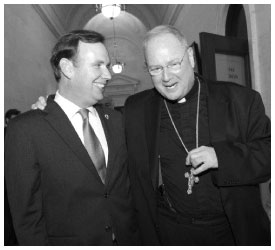

Properly Reimbursing Independent and Religious Schools

Assemblyman Cusick discusses the CAP reimbursement legislation with Cardinal Timothy Dolan at the State Capitol in Albany.

Cusick is the prime sponsor of legislation which allows independent and religious schools to collect

the correct amount of reimbursements for their actual CAP costs (

A.9467).

“This is a common sense measure that uses a straightforward formula for reimbursement to independent and religious schools,” Assemblyman Cusick stated. “These institutions need to be reimbursed fully for costs they incur in complying with state mandates.”

A significant deficit has accrued in reimbursement to private schools because of the problem with the reimbursement formula. The agreed upon budget not only restores the correct reimbursement formula, it adds money to help ensure that schools are fully reimbursed this year and requires the State Education Department to develop a plan to address the deficit under the program.

“I am pleased that the Governor and both Houses were able to address this critical situation. The economic crisis we are experiencing is also affecting Catholic, Jewish and other non-public schools and this budget helps to address that crisis,” said Assemblyman Cusick.