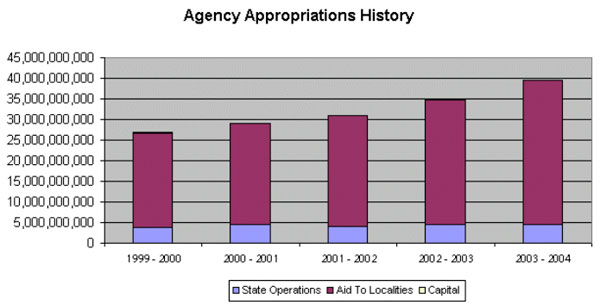

* 1999-00 through 2001-02 reflect enacted appropriations.

* 2002-03 and 2003-04 reflect Executive recommended appropriations.

| 2003 Yellow Book | |||||

| Backward | Forward | Cover | Overview | Agency Summaries | Agency Details |

|

Department of Health (Summary) View Details |

|

|

|||||

|

Adjusted Appropriation 2002-03 |

Executive Request 2003-04 |

Change |

Percent Change |

||

|

|

|||||

| AGENCY SUMMARY | |||||

|

|

|||||

| General Fund | 6,809,318,768 | 6,259,992,600 | (549,326,168) | -8.1% | |

| Special Revenue-Federal | 22,970,992,000 | 27,161,546,000 | 4,190,554,000 | 18.2% | |

| Special Revenue-Other | 4,103,255,000 | 4,828,726,000 | 725,471,000 | 17.7% | |

| Capital Projects Fund | 156,800,000 | 76,600,000 | (80,200,000) | -51.1% | |

| Fiduciary | 4,225,000 | 4,675,000 | 450,000 | 10.7% | |

| Enterprise | 10,000 | 10,000 | 0 | 0.0% | |

| Total for Agency: | 34,044,600,768 | 38,331,549,600 | 4,286,948,832 | 12.6% | |

| Total Contingency: | 950,000,000 | 1,230,000,000 | 280,000,000 | 29.5% | |

|

|

|||||

| Total for AGENCY SUMMARY: | 34,994,600,768 | 39,561,549,600 | 4,566,948,832 | 13.1% | |

|

* 1999-00 through 2001-02 reflect enacted appropriations.

|

|

|

|||

|

ALL FUNDS PERSONNEL BUDGETED FILL LEVELS |

|||

| Fund |

Current 2002-03 |

Requested 2003-04 |

Change |

|

|

|||

| General Fund: | 2,358 | 2,084 | (274) |

| All Other Funds: | 3,617 | 3,828 | 211 |

|

|

|||

| TOTAL: | 5,975 | 5,912 | (63) |

|

|

|

Budget Highlights |

|

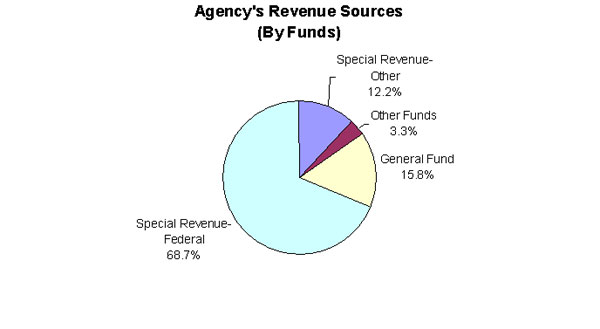

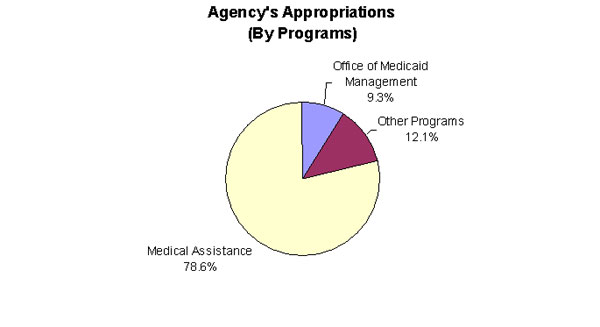

As the designated State agency responsible for promoting and supervising public health activities, ensuring sound and cost effective quality medical care, and reducing infectious diseases, the Department of Health (DOH) works toward its goal of ensuring the highest quality, most appropriate and cost-effective health care for all New Yorkers. Since State Fiscal Year (SFY) 1996-97, when authority for the State's Medical Assistance (Medicaid) Program was transferred from the former Department of Social Services, the Department of Health has served as the principal State agency responsible for interacting with the Federal and local governments, health care providers, and program participants on behalf of the Medicaid Program in New York. Transfer of all Medicaid functions to the Department of Health consolidated for the first time in one agency the operational and oversight responsibilities for the Medicaid Program, thereby clarifying State accountability for Medicaid policy and allowing for greater efficiencies in the administration of health care programs. This Agency is included in the Health and Mental Hygiene appropriation bill. The Governor recommends All Funds appropriations for the Department of Health (DOH) totaling $39,561,549,600, an increase of $4,566,948,832, or 13.1 percent, over State Fiscal Year (SFY) 2002-03, primarily attributable to an increase in both Special Revenue Fund Federal and Special Revenue Fund Other appropriations. The Governor recommends General Fund appropriations for the Agency totaling $6,259,992,600, a decrease of $549,326,168, or 8.1 percent below the current fiscal year. Additionally, the Governor recommends Special Revenue Funds Federal appropriations for the Agency totaling $27,161,546,000, an increase of $4,190,554,000, or 18.2 percent over SFY 2002-03. The Executive further recommends a Special Revenue Fund-Other appropriation of $4,828,726,000, an increase of $725,471,000, or 17.1 percent over last year. The adjusted appropriations for the Department of Health (DOH) include recommended deficiency appropriations for General Fund and Special Revenue Funds - Other in Aid to Localities totaling $134,000,000. The proposed allocation of those funds is as follows: the Medicaid Program, $100,000,000; and the Elderly Pharmaceutical Insurance Coverage (EPIC) Program, $34,000,000. The Executive proposes to sweep $1,700,000 from the Special Revenue Other /State Operations Triplicate Prescription Forms Account to offset General Fund spending in SFY 2003-04. State Operations The Executive recommends a total All Funds appropriation for State Operations of $4,542,452,600, which reflects an increase of $31,293,600, or 0.69 percent over State Fiscal Year (SFY) 2002-03. This increase is primarily due to increased Federal funds. The Executive proposes General Fund State Operations appropriations totaling $167,785,600, a net decrease of $43,468,400, or 20.58 percent due primarily to reductions and shifts in personal service. The Executive also recommends Special Revenue Funds-Federal totaling $3,961,720,000, an increase of $60,041,000 or 1.54 percent. The Executive proposes the attrition of 165 positions throughout the agency, of which 88 positions would generate General Fund savings. The Executive proposes further General Fund savings through the abolition of 58 positions and a shift of 47 positions from the General Fund to various other funds. The Executive also proposes to shift 136 positions from the Department of Health (DOH) to the State Insurance Department (SID). Specifically, the Executive proposes to shift 56 positions from the newborn hearing program, as well as all personal service (80 positions) and non-personal service costs from the Center for Community Health Program, to Special Revenue-Other accounts within the State Insurance Department that are funded with insurance assessments. This action would result in a General Fund savings of $16,000,000 in SFY 2003-04. The Executive also proposes to fill 160 vacant positions agency wide in SFY 2003-04. The Executive recommends funding 55 positions with General Fund dollars and the remaining 105 positions with various Special Revenue Other funds throughout the agency. Of the 55 positions funded with General Fund dollars, the Governor proposes to fill 15 positions in the Wadsworth Center for Laboratories and Research associated with bio-terrorism activities. The Governor also proposes to fill 25 positions in the Health Care Surveillance Program and the Office of Continuing Care Program to perform surveillance activities, and 15 positions in the Medicaid Audit and Fraud Prevention Program to perform various audit and fraud activities. Institutional Management The Executive proposes to reduce the Roswell Park Cancer Institute's scheduled allocation amount in the Health Care Reform Act (HCRA) from $90,000,000 to $80,000,000 in SFY 2003-04 The Department of Health currently maintains five direct care institutions: Helen Hayes Hospital in West Haverstraw and four nursing homes for the care of veterans and their dependents, Oxford, New York City, Montrose, and Western New York. The Executive proposes a $2,378,000 funding increase for the Montrose Veterans' Nursing Home, a 252-bed facility in the lower Hudson Valley that opened in mid October 2001. Additionally, the Executive proposes a $4,821,000 increase for Helen Hayes Hospital and a $470,000 increase for the Western New York Veterans' Home. Aid To Localities The Executive recommends All Funds Aid to Localities appropriations totaling $33,712,497,000, a net increase of $4,335,855,232, or 14.76 percent from the SFY 2002-03 funding level. This increase is primarily attributable to an increase in Special Revenue Fund-Federal. The Executive proposes General Fund appropriations totaling $6,092,207,000, a decrease of $505,857,768, or 7.67 percent from SFY 2002-03. The Executive also recommends a Special Revenue Fund-Federal appropriation totaling $23,199,826,000, an increase of $4,130,513,000, or 21.66 percent. The proposed $711,200,000 increase in Special Revenue Funds Other is largely the result of a shift from General Fund spending. For the Early Intervention (EI) Program, the Executive recommends an appropriation of $270,888,000 for SFY 2003-04, a cash increase of $50,003,000 over SFY 2002-03 due to both enrollment growth and increased use in services. The Executive also proposes various changes to the Early Intervention program for SFY 2003-04. The Executive proposes a new "Medicare-like" funding structure that would change the cost-sharing components of the program. The State and localities would both assume 40 percent of Early Intervention costs after health insurance deductions, and parents would be responsible for the remaining 20 percent of the costs. Parental contributions would vary by income and families under 160 percent of the Federal Poverty Level (FPL) would not be required to pay a contribution. Currently, the state and localities equally share the cost of Early Intervention services, after health insurance deductions. The Executive's Early Intervention proposal would also require Early Intervention (EI) providers to bill the Medicaid program or other insurance programs directly, and authorize counties to negotiate rates with Early Intervention providers. The Executive also proposes to evaluate children in the Early Intervention Program before their third birthday to determine if they still require Early Intervention services. Children who have been evaluated and have been found to no longer require Early Intervention services would be discharged from the program. Children who have been evaluated and found to require continued services would be transitioned to the Pre- K Special Education program. The Executive estimates that localities would save $41,000,000 in SFY 2003-04 from the proposed initiatives. The Executive does not estimate any State savings resulting from the proposed measures until SFY 2004-05 because of the payment lag in the Early Intervention Program. The Executive proposes a $34,000,000 deficiency appropriation in the Elderly Pharmaceutical Insurance Coverage (EPIC) Program in SFY 2002-03 due to increased enrollment and pharmaceutical costs. The Executive's proposed budget in SFY 2003-04 provides $578,000,000 in funding for the EPIC program, a net increase of $93,100,000 over SFY 2002-03, at a level consistent with program growth that is offset by proposed spending reductions of $38,100,000 to the EPIC program. Specifically, the Executive proposes to cut drug reimbursement rates for all pharmacies participating in the EPIC program from the Average Wholesale Price (AWP) minus 10 percent to the Average Wholesale Price (AWP) minus 15 percent. This action is expected to generate a $34,100,000 savings to the EPIC program in SFY 2003-04. The Executive also proposes to increase fees paid by program participants by 10 percent, totaling $1,500,000 in SFY 2003-04. The Executive also proposes to increase deductibles paid by program participants by 10 percent, totaling $2,500,000 in SFY 2003-04. The Executive recommends an appropriation of $168,000,000 in SFY 2003-04 in the General Public Health Works Program to support local public health activities. This program will experience a net cash decrease of $17,653,000 as a result of the actions proposed by the Executive to lower or eliminate State reimbursement to counties, resulting in State savings of $32,338,000 in SFY 2003-04. The Executive proposes to reduce State reimbursement from 36 percent to 30 percent for "core" services and to eliminate State reimbursement for "optional" services. The current State aid reimbursement to counties for "optional" services is 30 percent. The Executive also proposes to eliminate various programs throughout the agency. Specifically, the Executive propose to eliminate the: rural health program, $267,000; hypertension program, $940,000; Sudden Infant Death Syndrome (SIDS) progam, $152,000; diabetes program, $550,000; children's asthma program, $200,000; osteoporosis prevention program, $200,000; and the childhood cancer awareness program, $125,000. The Executive further proposes to eliminate public health programs that were enacted during the 2001 and 2002 legislative sessions. These programs include: the Alzheimer's Tax Check-Off General Fund Match (Chapter 359 of the Laws of 2002); the Endoscopy Study (Chapter 438 of the Laws of 2002); the Reflex Sympathetic Dystrophy Syndrome Prevention and Education Program (Chapter 429 of the Laws of 2002); the Obesity Prevention program (Chapter 538 of the Laws of 2002); and the Tattooing and Body Piercing License and Regulation program (Chapter 562 of the Laws of 2001). In the proposed SFY 2003-04 budget, the Executive eliminates $4,000,000 for the Adult Care Facility Quality Incentive Payment (QUIP) Program. The Executive recommends a new $8,000,000 funding stream related to adult home initiatives, of which $4,000,000 would be funded with General Fund dollars; the other $4,000,000 in SFY 2003-04 would be funded from Health Care Reform Act of 2000 (HCRA 2000) revenues. The proposed allocations would provide funding for case management activities, medication management, social and recreational services, assessments, and advocacy and legal support initiatives that the Department of Health would implement cooperatively with the Office of Mental Health, the Commission on Quality Care for the Mentally Disabled, and the State Office for the Aging. Other notable changes proposed by the Executive in Aid to Localities include:

Medical Assistance (Medicaid) Program The Executive recommends an All Funds Medicaid appropriation in Aid to Localities of $29,850,309,000, which is a net increase of $4,286,729,000, or 16.77 percent, resulting from an increase in both Federal funds and Special Revenue Funds Other. The Executive estimates Medicaid General Fund Aid to Localities disbursements in the Department of Health will be $5,949,780,000 in SFY 2002-03. This total includes a requested deficiency appropriation of $100,000,000. The Executive attributes this deficiency to: additional pharmacy costs, $60,000,000; additional nursing home costs, $15,000,000; additional transportation costs, $15,000,000; and additional costs in other areas of the Medicaid program, $10,000,000. For State Fiscal Year 2003-04, the Executive proposes a total General Fund Medicaid appropriation of $5,464,409,000, a net decrease of $485,371,000, or 8.16 percent over the SFY 2002-03 adjusted appropriation. This estimate relies on both the continuation of current cost containment actions already in the Governor's base, as well as proposed new cost containment actions, new assessments to healthcare providers, and federal maximization and other efforts. In the proposed budget, the Executive recommends a State Share savings of approximately $1,232,000,000 to the Medicaid program in SFY 2003-04. Specifically, the Governor proposes: new Medicaid cuts, $640,000,000; new federal maximization and other efforts, $260,500,000; and other reductions to the Medicaid program, $331,100,000. The impact of the new Medicaid cuts would affect nearly all of the State's health care providers, precipitating a loss of nearly 1.6 billion in combined Federal, State, and local reimbursement. New Medicaid Provider Cuts The Executive proposes new cuts to health care providers, totaling approximately $640,000,000 in State share savings in SFY 2003-04. The Executive proposes new cuts to the pharmacy sector, which would result in a net State share savings of $100,200,000 in SFY 2003-04. Specifically, the Governor proposes: lowering pharmacy reimbursement to the Average Wholesale Price (AWP) minus to 15 percent, $81,400,000; requiring pharmacies to bill Medicare, when allowable, for dually eligible recipients, $3,000,000; achieving enhanced rebates from the Preferred Drug Program, $5,700,000; and adding select pharmaceuticals to the prior authorization list, $13,000,000. The Executive also recommends an increase of $2,900,000 in new administrative costs associated with the prior authorization and preferred drug programs. The net saving reflects the State picking-up the entire non-federal share of pharmaceutical costs, effective April 1, 2003. The Executive also proposes new cuts to the hospital sector, which would result in a total State savings of $242,900,000 in SFY 2003-04. Specifically, the Governor proposes: re-establishing the 0.7 percent assessment for four years (reduced by 25 percent each year), $190,200,000; eliminating the trend factor, $14,400,000; restructuring Graduate Medical Education, $15,700,000; limit group average of case payment, $7,800,000; eliminating length of stay adjustment, $4,600,000; eliminate certain part-time clinics, $5,200,000; decrease per-diem rates by 5 percent (exempts AIDS services), $4,000,000; and freezes specialty-clinic rates (exempts AIDS services), $1,000,000. These savings reflect the Executive's proposal to decrease the State's financial responsibility for hospital and clinic costs to 13 percent and to increase the local share by 12 percent (from 25 percent to 37 percent) for these sources. The Executive also proposes new cuts to the nursing home sector, which would result in a total State savings of $157,600,000 in SFY 2003-04. The Executive proposes to: implement the regional average reimbursement methodology, $59,900,000; eliminate the trend factor, $46,700,000; implement the Medicaid-only case mix adjustment, $46,000,000; and eliminate the return on equity for proprietary nursing homes, $5,000,000. The Executive's proposed cuts to the home care sector would total a net State savings of $39,100,000 in SFY 2003-04. The Governor' s proposals include: eliminating the trend factor, $15,400,000; re-establishing the 0.6 percent assessment for four years (reduced by 25% each year), $17,000,000; and establishing utilization review for Certified Home Health Agencies (CHHAs), $7,300,000. The Executive also proposes new administrative costs associated with utilization review procedures, totaling $600,000 in SFY 2003-04. The Executive also proposes various other provider cuts to the Medicaid program, totaling $100,300,000 in State savings. The new proposals would:

Other New Impacts to the Medicaid Program The Executive also proposes State savings of $331,100,000 in other proposed actions that further reduce Medicaid expenditures in SFY 2003-04. Medicaid General Fund spending is decreased in the Executive budget by $227,000,000 in SFY 2003-04 related to a Governor's proposal for the State to assume the entire non-Federal share of pharmaceutical costs while shifting to localities a greater financial responsibility for hospital inpatient and out-patient costs, and clinic services. Under the new arrangement, local districts would be responsible for 37 percent of expenditures (an increase from the current 25 percent) and the State would retain responsibility for 13 percent of expenditures (down from the current 25 percent). The Executive further proposes to shift children in families with incomes between 100 to 133 percent of the Federal Poverty Level (FPL) from Medicaid to the Child Health Plus (CHP) program. This action is expected to generate a $42,000,000 State share savings to the Medicaid program. The Executive also proposes to decrease Family Health (FHP) eligibility levels for adults with children from 150 percent to 133 percent of the Federal Poverty Level (FPL), which would result in State savings of $20,000,000 in SFY 2003-04. In addition, the Executive proposes a new "forge proof" prescription program to require the use of non-reproducible prescription forms, which would result in a State savings of $400,000 in SFY 2003-04 but would increase to a State savings of $28,000,000 when fully annualized. The Executive also proposes to increase Medicaid co-payments from 50 cents to $1.00 for generic drugs and from $2.00 to $3.00 for brand name drugs, which would result in a State savings of $7,000,000 in SFY 2003-04. The Executive would also require recipients who are enrolled in the Medicaid Managed Care program to pay co-payments on prescription drugs at the proposed increased levels, which would result in State savings of $6,100,000 in SFY 2003-04. Currently, Medicaid Managed Care enrollees are not required to make co-payments for prescription drugs. The Executive also proposes to cap overburden payments to localities at 2002 levels, which would result in a State share savings of $25,000,000 in SFY 2003-04. This action will shift to localities a new cost totaling $25,000,000 in SFY 2003-04. The Executive further reduces State Share Medicaid spending in SFY 2003-04 by: lowering the utilization review threshold for certain services, $2,600,000 ; and enhancing utilization review and transportation audits in New York City, $3,000,000. The Executive also estimates increased administrative costs associated with lowering utilization review thresholds and increasing Medicaid co-payments, totaling $2,000,000 in SFY 2003-04. Federal Maximization and Other Revenues The Executive proposes a State Share savings of $260,500,000 in additional federal maximization actions, as well as transferring additional General Fund expenditures to HCRA. The Executive's proposed actions include: additional inpatient hospital Upper Payment Limit (UPL) revenues, $129,000,000; additional nursing home Upper Payment Limit (UPL) revenues, $15,000,000; and transfer of additional pharmacies expenditures to HCRA, $116,500,000. Health Care Reform Act The Executive proposes to extend for an additional two years, through June 30, 2005, the Health Care Reform Act of 2000 (HCRA 2000), but recommends significant amendments to various provisions. The Executive proposes to reduce allocations in the Health Care Initiatives Pool by $120,000,000 by reducing funding for the:

The Executive also proposes to eliminate the Catastrophic Health Insurance Program for a savings to HCRA of $10,800,000 over two years. The Executive also proposes to reduce allocations by $19,800,000 over two years in the Tobacco Control and Insurance Initiatives Pool by reducing the:

The Executive also proposes new revenues to HCRA, including:

The increases in revenue to various HCRA program pools would be offset by the loss of tobacco settlement payments, which are proposed to be securitized. The Executive estimates a loss to HCRA of $847,000,000 over two years, associated with the tobacco securitization proposal. Capital Projects The Executive recommends an All Funds Capital Projects appropriation of $76,600,000, a decrease of $80,200,000 or 51.15 percent over SFY 2002-03, primarily due to a decrease of $70,000,000 in the Safe Drinking Water - Clean Water/Clean Air (CWA) fund. Article VII The Executive proposes:

Medicaid Managed Care

Medicaid Cost Containment

|

|

|

|||||

| Backward | Forward | Cover | Overview | Agency Summaries | Agency Details |

|

New York State Assembly [Welcome] [Reports] |