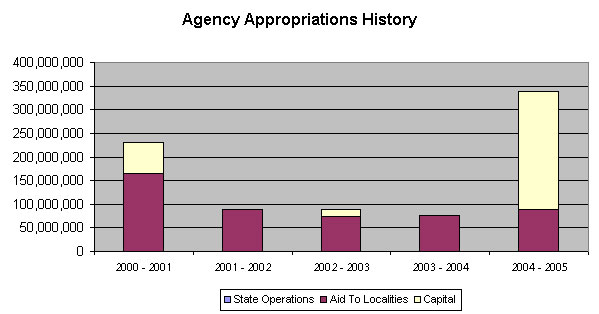

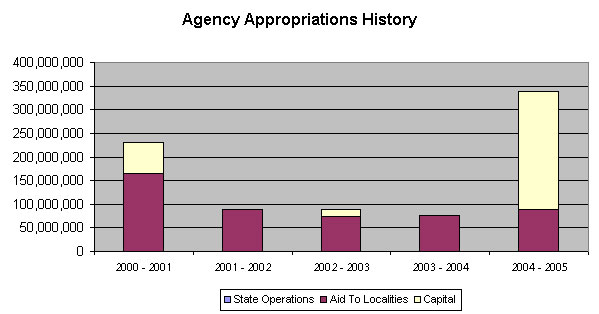

* 2000-01 through 2002-03 reflect enacted appropriations.

* 2000-01 through 2002-03 reflect enacted appropriations.* 2003-04 and 2004-05 reflect Executive recommended appropriations.

| 2004 Yellow Book | |||||

| Backward | Forward | Cover | Overview | Agency Summaries | Agency Details |

|

URBAN DEVELOPMENT CORPORATION (Summary) View Details |

|

|

|||||

|

Adjusted Appropriation 2003-04 |

Executive Request 2004-05 |

Change |

Percent Change |

||

|

|

|||||

|

|

|||||

| AGENCY SUMMARY | |||||

|

|

|||||

| General Fund | 75,362,100 | 78,362,100 | 3,000,000 | 4.0% | |

| Special Revenue-Other | 0 | 10,000,000 | 10,000,000 | -- | |

| Capital Projects Fund - Authority Bonds | 0 | 250,000,000 | 250,000,000 | -- | |

|

|

|||||

| Total for AGENCY SUMMARY: | 75,362,100 | 338,362,100 | 263,000,000 | 349.0% | |

* 2000-01 through 2002-03 reflect enacted appropriations.

* 2000-01 through 2002-03 reflect enacted appropriations.* 2003-04 and 2004-05 reflect Executive recommended appropriations. |

|

|

| Budget Highlights |

|

The Urban Development Corporation (UDC) is currently doing business as the Empire State Development Corporation (ESDC). The mission of the UDC is to promote economic and real estate development by providing financial assistance to local governments, businesses and not-for-profit corporations engaged in economic development activities. In addition, the Corporation is engaged in housing portfolio maintenance and provides State facility financing for the construction and modernization of State correctional facilities, as well as other special projects. |

|

The Urban Development Corporation is included in the Transportation, Economic Development and Environmental Conservation appropriation bill. |

|

Aid To Localities |

|

The Executive recommends an All Fund appropriation of $88,362,100, a net increase of $13,000,000 over State Fiscal Year (SFY) 2003-04 funding levels. |

|

The Executive proposal provides no new State funds to finance SFY 2004-05 recommended appropriations totaling $75,350,000 for the Jobs Now Program, the Economic Development Fund (EDF) Program, the Urban and Community Development Program (UCDP), the Minority and Women-owned Business Development and Lending (MWBDL) Program, the Military Base Reuse and Redevelopment Initiatives, and the Military Base Retention Efforts. Rather, the Executive proposal would require UDC to use corporate bond proceeds issued for SFY 2003-04 programs to support programmatic activity during SFY 2004-05. The Executive proposal would provide no General Fund support in SFY 2004-05 for programs appropriated in the following amounts: |

|

|

|

|

|

|

The Executive proposes to provide a $3,000,000 General Fund appropriation for the retention of professional football in Western New York. As part of a 1998 UDC agreement with the Buffalo Bills, the State is required to provide working capital grants starting in 2004 until 2012. |

|

The Executive recommends funding Payments to Municipalities Program with a $4,100 General Fund appropriation, reflecting no change from SFY 2003-04 levels. |

|

The Executive recommends the creation of the Electricity Savings Rebate Program to be funded through the New York Power Authority (NYPA) and administered by UDC. UDC will provide up to $10,000,000 in rebates for utility costs to businesses whose benefits under the Power for Jobs Program would expire in SFY 2004-05. |

|

Capital Projects |

|

The Executive provides a $250,000,000 Capital appropriation to support the creation of a new Regional Economic Growth Program. This program will support major economic development projects in New York State, such as high technology facilities, civic centers and other municipal facilities. |

|

Article VII |

|

The Executive has proposed language that would significantly alter the purpose, administration and benefits available through the Empire Zone program. The proposal would extend the program by five years to July 31, 2009. The Executive's proposal would provide the Commissioner of Economic Development with the authority to establish reporting requirements as well as performance measures for assessing the overall performance of the program; promulgate rules and regulations on how to certify significant investments within an empire Zone; develop, in conjunction with the Department of Tax and Finance, an annual report detailing the tax credits received under the Empire Zone program; and develop procedures for business enterprises to follow in order to be a certified business. In addition, the Executive would require local zones to develop a local zone development plan that would include criteria on how boundaries are to be established and the types of businesses that the zones will target. The Empire Zone proposal also includes major changes to the manner that zone boundaries are established. The proposal would require Zones designated by eligible census tracts to place their two square miles in up to three non-contiguous areas within a four square mile "superboundary". County-wide Zones would be required to place sixty percent of the available two square miles in six targeted areas. These targeted areas would be required to have levels of unemployment and poverty greater than the county average. The proposal also authorizes the Commissioner of Economic Development to create "flex zones" that would allow for the annual designation of up to one non-contiguous square mile throughout the State for major job creation projects. The Executive also recommends revising Empire Zone benefits and formulas to ensure that only businesses that create jobs and make significant investments will receive Empire Zone credits. Specifically, the bill would lower the tax benefit period from fifteen years to ten years for businesses certified after April 1, 2004; change the employment test used in determining the benefit status for businesses certified after April 1, 2004; amend real property tax eligibility so a certified business who makes PILOT payments may qualify for the real property tax credit; and eliminate the availability of benefits for Zone Equivalent Areas (ZEAs) that have not been selected by June 13, 2004. In addition, the Executive proposes that the Zone Capital Tax Credit will no longer be available for any new investments made after July 31, 2004. The Executive proposal includes Article VII language to authorize the Urban Development Corporation (UDC) to issue $250,000,000 in bonds or notes in support of a newly created Regional Economic Growth Program. This program will provide loans and/or grants to municipalities, businesses, colleges or other organizations for major economic development projects that would have significant regional impacts. Projects funded under this program must be over $500,000 and could include high technology facilities, civic centers or other municipality facilities. UDC will administer the program, establish program guidelines and review all applications. The Executive also recommends legislation authorizing the New York Power Authority (NYPA) to make contributions to the General Fund to support the Power for Jobs Program. The proposal also authorizes a new rebate program. The Executive proposes that NYPA contribute 100 percent of the gross tax receipts credit to the Power for Jobs program for phases IV and V of the program. The Executive estimates this amount at $100 million. The proposal caps NYPA's total contributions to the program at $235 million. The proposal also establishes a new $10 million customer rebate program to be administered through the Urban Development Corporation to fund Power for Jobs contracts that would expire before the end of SFY 2004-05. The Executive proposes to authorize the Dormitory Authority (DA) to provide $1,200,000 to support the operations of the Cornell Theory Center supercomputer. The Executive proposes to make the UDC's general loan powers permanent. The Corporation's loan powers are set to expire on July 1, 2004. |

|

|

|||||

| Backward | Forward | Cover | Overview | Agency Summaries | Agency Details |

|

New York State Assembly [Welcome] [Reports] |