|

References

Acemoglu, D. 1998. Why do new technologies complement skills? Directed

technical change and wage inequality. Quarterly Journal of Economics, CXIII,

1055-1090.

Allgood, S and A Snow. 1998. The marginal cost of raising tax revenue and redistributing

income. Journal of Political Economy, 106, 1246-1273.

Anderson, DA. 1999. The aggregate burden of crime. Journal of Law and Economics,

XLII, 611-642.

Arum, R and IR Beattie. 1999. High school experience and the risk of adult incarceration.

Criminology, 37, 515-537.

Barrett, A and A Poikolainen. 2006. Food Stamp Program Participation Rates, 2004.

U.S. Department of Agriculture: Alexandria, Virginia.

Barrow, L and CE Rouse. 2005. Do Returns to Schooling Differ by Race and Ethnicity?

Education Research Section, Princeton University, Working Paper Number 11.

Belfield, CR, Nores, M, Barnett, WS and L Schweinhart. 2006. The Perry Pre-School 40-year

Follow-up Cost-Benefit Analysis. Journal of Human Resources, 42, 215246.

Bureau of Justice Statistics (BJS). 2002. Sourcebook of Criminal Justice Statistics.

30th Edition. Department of Justice, Washington, DC.

Cameron, SV and JJ Heckman. 1993. The nonequivalence of high school equivalents.

Journal of Labor Economics, 111, 1-47.

Carneiro, P and JJ Heckman. 2003. Human Capital Policy. In Inequality in American:

What Role for Human Capital Policies? BM Friedman (Ed.). Cambridge, MA: MIT Press.

Cohen MA, Rust RT, Steen S, and ST Tidd. 2004. Willingness-to-pay for crime control programs.

Criminology, 42, 89-109.

Cohen, MA. 2005. The Costs of Crime and Justice. Routledge: New York.

CRS. 2004. Cash and non-cash benefits for persons with limited income: Eligibility rule,

recipient, and expenditure data, FY 2000-2002. Congressional Research Service,

Report RL32233.

Cutler, D, and A Lleras-Muney. 2006. Education and health: evaluating theories and evidence.

NBER Working Paper.

De Jesús, A and DW Vasquez. 2005. Exploring the education profile and pipeline for Latinos

in New York State. Paper, NYLarnet, www.nylarnet.org

Dee, T. 2004. Are there civic returns to education? Journal of Public Economics,

88, 1697-1720.

Farrington, DP. 2003. Developmental and life-course criminology: Key theoretical and

empirical issues. Criminology, 41, 221-246.

Federal Bureau of Investigation (FBI). 2004. Crime in the United States. www.fbi.gov

Fullerton, D. 1991. Reconciling recent estimates of the marginal welfare cost of taxation.

American Economic Review, 81, 302-308.

Glennan, TK, Bodilly, SJ, Galegher, JR, and KA Kerr. 2004. Expanding the Reach of

Education Reforms. RAND: Washington DC.

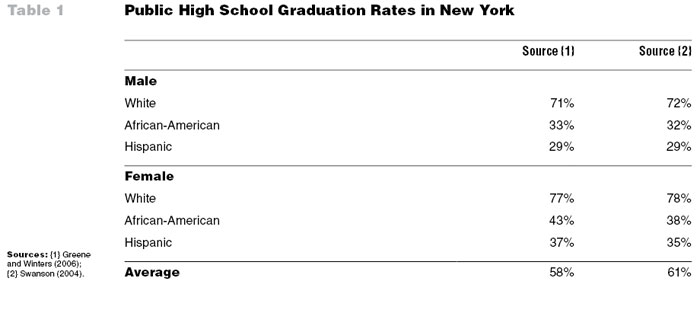

Greene, JP and M Winters. 2006. Leaving Boys Behind: Public High School Graduation

Rates. www.manhattan-institute.org/pdf/cr_48.pdf

Grogger, J. 2004. Welfare transitions in the 1990s: The economy, welfare policy, and

the EITC. Journal of Policy Analysis and Management, 23, 671-695.

Holzer, HJ, Offner, P and E Sorensen. 2004. Declining employment amount young black

less-educated men: The role of incarceration and child support. National Poverty Center

Working Paper Series, University of Michigan.

Holzman, M. 2004. Public Education and Black Male Students: A State Report Card.

Schott Foundation for Public Education, Policy Paper.

Jayakody, RS, Danziger, S and H Pollock. 2000. Welfare reform, substance abuse, and

mental health. Journal of Health Politics, Policy and Law, 25, 223-243.

Kirsch, I, Braun, H, Yamamoto, K and A Sum. 2007. America’s Perfect Storm. Three Forces

Facing Our Nation’s Future. ETS Policy Brief.

Kuziemko, I. 2006. Using shocks to school enrollment to estimate the effect of school

size on student achievement. Economics of Education Review, 25, 63-75.

Levin, H, Belfield, C, Muennig, P and C Rouse. 2007. The costs and benefits of an excellent

education for America’s children. Working paper, www.cbcse.org.

Levitt, SD and L Lochner. 2001. The determinants of juvenile crime. In J Gruber (Ed.) Risky

Behavior among Youths. An Economic Analysis. University of Chicago Press: Chicago.

Lochner, L and E Moretti. 2004. The effect of education on crime: Evidence from prison inmates,

arrests, and self-reports. American Economic Review, 94, 155-189.

Ludwig, J. 2006. The cost of crime: Understanding the financial and human impact of criminal activity.

Testimony, US Senate Committee on the Judiciary, September 19, 2006.

Macmillan, R. 2000. Adolescent victimization and income deficits in adulthood: rethinking the costs

of criminal violence from a life-course perspective. Criminology, 38, 533-580.

Maynard, R. 1997. Kids Having Kids: Economic Costs and Social Consequences of Teen Pregnancy.

Urban Institute Press, Washington, DC.

Miller, TR, Cohen, MA, and B Wiersema. 1996. Victim Costs and Consequences: A New Look.

National Institute of Justice Research Report, NCJ-155282.

Moore, MA, Boardman, AE, Vining, AR, Weimer, DL and DH Greenberg. 2004. Just give me a

number! Practical values for the social discount rate. Journal of Policy Analysis and

Management, 23, 789-812.

Muennig, P. 2005. Health returns to education interventions. Available online at:

http://devweb.tc.columbia.edu/centers/EquityCampaign/symposium/Files/81_Muennig_paper.ed.pdf

Accessed 11/05.

Orfield, G, Losen, D, Wald, J and CB Swanson. 2004. Losing Our Future: How Minority Youth are

Being Left Behind by the Graduation Rate Crisis. Cambridge, MA: The Civil Rights Project at

Harvard University.

Osborne Daponte, B, Sanders, S, and L Taylor. 1999. Why do low-income households not use

food stamps? Journal of Human Resources, 34, 612-628.

Pager, D. 2003. The mark of a criminal record. American Journal of Sociology,

108, 937-975.

Pettit, B and B Western. 2004. Mass imprisonment and the life course: race and class inequality

in US incarceration. American Sociological Review, 69, 151-169.

Quint, J. 2006. Meeting Five Critical Challenges of High School Reform. New York: Manpower

Development Research Corporation [MDRC].

Rank, MR and TA Hirschl. 2005. Likelihood of using food stamps during the adulthood years.

Journal of Nutrition and Behavior, 37, 137-146.

Raphael, S. 2004. The socioeconomic status of black males: The increasing importance of

incarceration. Working paper, UC-Berkeley.

Roberts, DE. 2004. The social and moral costs of mass incarceration in African-American

communities. Stanford Law Review, 56, 1271.

Rothstein, R. 2004. Class and Schools. Using Social, Economic and Educational Reform to

Close the Black-White Achievement Gap. Teachers College Press and Economic Policy

Institute: Washington, DC.

Rouse, CE. 2005. The costs of inadequate education. Working Paper, Teachers College

devweb.tc.columbia.edu/manager/symposium/Files/77_Rouse_paper.pdf

Rumberger, R. 2004. Why students drop out of school. In Dropouts in America.

G Orfield (Ed). Harvard Education Press: Cambridge, MA.

Schmitt, J and D Baker. 2006. The Impact of Undercounting in the Current Population Survey.

Working paper, Center for Economic Policy and Research, Washington DC,

www.cepr.net/publications/cps_declining_coverage_2006_08.pdf

Schwartz, AE and L Stiefel. 2004. Immigrants and the distribution of resources within an urban

school district. Educational Evaluation and Policy Analysis, 26, 4: 303-327.

Stephan, J. 1999. State Prison Expenditures, 1996. U.S. Department of Justice,

Washington, DC.

Swanson, C. 2004. Projections of 2003-04 High School Graduates: Supplemental Analyses.

Urban Institute, www.urban.org/UploadedPDF/411019_2003_04_HS_graduates.pdf

Tienda, M. 2007. Changing demography. In CR Belfield and HM Levin (eds). The Price We Pay.

Brookings Institution Press: Washington, DC.

US DHHS, ACF. 2004. TANF Sixth Annual Report to Congress. DHHS: Washington, DC.

Van Dorn, RA, Bowen, GL, and JR Blau. 2006. The impact of community diversity and consolidated

inequity on dropping out of high school. Family Relations, 55, 105-118.

Waldfogel, J, Garfinkel, I and B Kelly. 2005. Public assistance programs: How much could be

saved with improved education? Working paper for Education Symposium, Teachers College,

Columbia University.

Western, B, and B Petit. 2000. Incarceration and racial inequality in men’s employment.

Industrial and Labor Relations Review, 54, 3-16.

Wolf Harlow, C. 2003. Education and correctional populations. Bureau of Justice Statistics

Special Report, Washington, DC: U.S. Department of Justice.

Wong, MD, MF Shapiro, Boscardin WJ, and SL Ettner. 2002. Contribution of major diseases

to disparities in mortality. New England Journal of Medicine, 347, 1585-92.

Wyckoff, J. 2006. The imperative of 480 schools. Education Policy and Finance,

1, 279-287.

|