|

|

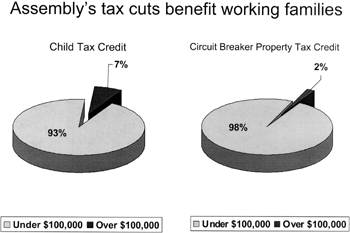

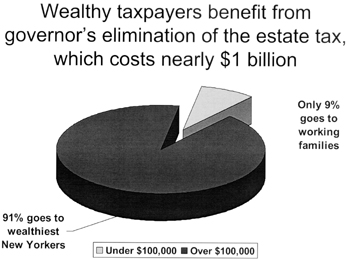

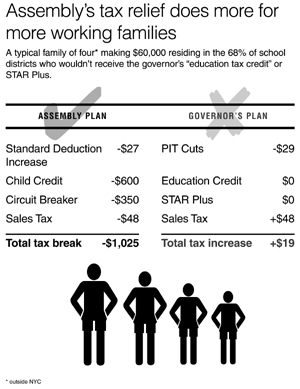

The Assembly’s budget plan would provide more than $2.4 billion in tax relief for working families. The Assembly’s Doing More For More New Yorkers tax cut package delivers 90 percent of the benefits to 90 percent of the taxpayers, a vast improvement over the governor’s plan, in which 83 percent of the benefits go to the wealthiest 13 percent.

The governor can continue to push tax cuts for the rich, but the Assembly is targeting tax relief for those who need it most – hard-working families, homeowners, tenants and seniors. The Assembly Majority will fight for a final state budget that provides real tax relief to real New Yorkers.

|

Relief from high property taxes. The Assembly budget proposes nearly $900 million in tax credits to more than 2.6 million homeowners and renters across the state. This “circuit breaker” property tax relief program protects taxpayers from a property tax overload just like an electric circuit breaker. When a property tax bill exceeds a certain percentage of a taxpayer’s income, the circuit breaker reduces property taxes in excess of this overload level.

Local taxpayers need immediate relief from the burden of high property taxes and soaring housing costs. Improving upon the Circuit Breaker program is a significant step toward helping ease that burden. The Assembly’s budget provides additional property tax relief by:

-

Saving taxpayers over $3 billion through the STAR program, which lowers the school tax bill for working families and seniors

-

Capping local Medicaid costs, saving local governments $1.1 billion

-

Increasing funding to municipalities by $150 million to help keep them from passing tax increases on to their residents

-

Increasing school funding by $1.33 billion over last year, improving our schools and keeping property taxes in check

|

|

A child tax credit for every child. A major part of the Assembly’s budget contains $620 million in tax relief to New York families with children. The typical family, earning between $24,000 and $110,000, will receive a $300 per child tax credit when fully phased in. The Assembly rejects the governor’s shortsighted plan, which is a limited tax credit for private school tuition and other educational expenses.

The Assembly’s plan is fairer because it applies to all families with children – not just a select few – and it is an automatic tax credit based on the federal government’s child tax credit. The governor’s proposal requires families to spend money on education needs first before receiving a tax credit reimbursement. Moreover, the Assembly’s tax credit will help families with all costs associated with raising a family, like food, medical bills and heating a home.

|

This is not a tax cut. It’s a gift to the parents of private and religious school students. Every dollar spent on

vouchers is another dollar local property taxpayers have to pay.

Dick Iannuzzi, NYSUT President, on governor’s tax cut plan |

Eliminating the marriage penalty tax. The Assembly would also eliminate the marriage penalty tax and increase the standard deduction for heads of household to equal those married filing jointly – raising the head of household deduction from $10,500 to $15,000, saving the typical taxpayer about $300 a year. These two proposals will save New Yorkers about $230 million annually.

|

Rejecting the governor’s sales tax on clothing. The Assembly proposal rejects the governor’s extension of the state sales tax on clothing and footwear items priced under $110, which is scheduled to expire on April 1 and makes the promised elimination permanent – saving shoppers approximately $600 million a year.

The regressive 4 percent state sales tax on clothing and footwear costs working families hundreds of millions of dollars every year. Removing the sales tax will doubly benefit New York by keeping more money in the pockets of working families while helping small retail businesses compete with those in neighboring states, which have already exempted clothing purchases from state sales taxes.

Another highlight of the Assembly’s tax relief proposal includes a tax deduction for New York State National Guard members called to federal service – saving military families $1 million.

We must do everything we can to keep taxes down and let working families keep more of their hard-earned money. The Assembly is committed to negotiating a fair and on-time budget that provides much-needed tax relief. Now it’s up to the governor and Senate to work with us to make that a reality.

|

“Colabufo said the diocese supports both tax credit proposals but agrees the Assembly proposal is

fairer because it would be ‘across the board for all’ and not only for parents in districts with

underperforming schools.”

Excerpted from The Syracuse Post-Standard quoting Michael Colabufo, superintendent of the Roman Catholic Diocese of Syracuse’s schools, 3/16/06 |

|

“The Senate's inattention to the needs of average wage earners becomes starkly apparent when

you consider the tax cuts proposed by Assembly Speaker Sheldon Silver. His Democrats would eliminate the

clothing tax, worth $600 million in relief annually to average Joes and Janes. The Assembly also would give

income tax credits of up to $400 to families who spend more than 7.5% of their incomes on property taxes,

or more than 30% of their incomes on rent. Those are exactly the kinds of people who deserve relief.”

Daily News, |

The Assembly Internet Information Service is available to those interested in receiving timely legislative updates by e-mail. To subscribe to this service, please drop us a line at signup@assembly.state.ny.us, indicating your area of interest.

(The Assembly Internet Information Service will not release, sell or give away a subscriber’s e-mail address, name or any other information provided without express permission from the subscriber. Each e-mail notice or newsletter will contain simple instructions for removing your name from the mailing list if you decide you no longer wish to subscribe.)

[ Committee Page ] [ Assembly Home Page ]